Arranging a funeral can be traumatic for those left behind when a loved one passes. Amidst the grief, family members are often left to cover the costs ― which can range anywhere from $4000 to $15,000. There’s funeral director fees, legal certificates, transport, casket and burial plot or cremation services to cover...the list goes on.

By planning ahead with a prepaid funeral, you’ll be saving your family from unnecessary stress and financial burden when you pass — which gives everyone involved some piece of mind. But pre-paid funerals are a significant financial investment — so how can you compare prepaid funeral plans to make sure that the money you spend is going towards a legitimate funeral service provider?

What to look for in a pre-paid funeral plan

Many funeral companies claim to offer prepaid funeral plans, but only some of them will offer you financial security and flexibility in your options. To ensure the plan you are considering is legit, look for the following key features:

Payment options

If you’re the forward-thinking type, you’ll no doubt like the idea of smoothing the cost of major purchases out over a long period. There’s a few options available for doing this — such as funeral bonds and funeral insurance — but prepaid funeral plans are often the safest of these options. Not only are they considered more financially secure than funeral bonds, they generally work out cheaper for you in the long run if set up earlier in life.

Just because a funeral is prepaid, doesn’t mean you have to pay upfront. A good funeral company will give you the option of paying off your plan in instalments ― so beware of any provider who is not flexible in their terms of payment.

Remember: funeral service providers are required by law to give you a full breakdown of the costs included in your prepaid funeral. If you do not receive this on request, consider it a red flag (and a direct breach of the Competition and Consumer Act 2010).

Where your money is kept

The money you put towards your funeral plan — regardless of how it is paid — doesn’t simply go to your funeral service provider for ‘safe keeping’. Legitimate funeral companies will forward your money to an investment fund, where it will be immune from tax and interest changes until the funeral services are needed.

Caution: never hand your money over to a prepaid funeral provider who does not invest your money into a registered fund. To check whether a fund is legit, contact NSW Fair Trading’s Registry Services.

Flexibility in funeral arrangements

This is your service, and it should honour your individual wishes. You can request to have it personalised in any way that you like ― from reflecting religious denomination, cultural tradition or spiritual beliefs right down to favourite colours, music and flowers.

If you don't want to think about the specifics at this stage, you can still pay for the funeral through a prepaid plan. Your funeral director and family can work out the finer details later ― without the financial worry.

What is covered

Not all prepaid funeral plans are the same, and there can be a enormous variation in costs between providers. Some funeral directors only offer coverage for certain aspects of the funeral such as the ceremony. Take the time to carefully consider what different funeral plans do and don’t cover, and choose the one which suits you best.

Refunds and withdrawals

You generally can't claim your money back for a prepaid funeral package if you change your mind. However, at Lady Anne Funerals you reserve the right to cancel your plan and receive a full refund within 14 days of sign up, should you be unhappy with your choice.

Prepaid funeral services are considered an investment which is exempt from tax, and not included as part of Centrelink’s personal income and assets test. Like superannuation, this means it’s not possible to withdraw funds early, to use for other purposes.

What are my rights?

If you’re unsure as to whether the funeral plan you’re considering pre-purchasing is right for you, rest assured that you’re protected by consumer rights applicable to the funeral service industry. Many of the features outlined above are considered legal requirements for funeral funds operating in Australia. So if you come across a provider that contravenes any of the criteria listed above, contact NSW Fair Trading; the company may be in breach of their regulatory obligations.

That said, the law shouldn’t replace common sense! So do your research; like any consumer product, it’s a good idea to shop around before entering a major contract.

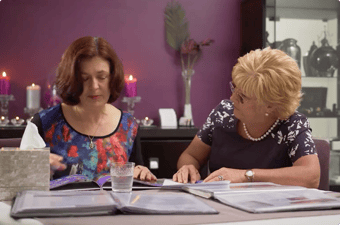

At Lady Anne Funerals, our compassionate team understand that it's difficult to think about making plans for what happens after you’re gone — let alone talk about it. That's why we don’t rush our clients; we like to spend time with you to chat about your wishes, your budget, and explore all of your options. So when the time comes, you’ll be farewelled with the ceremony you wanted ― whether it be religious, spiritual or celebratory.

Have you been thinking about prepaid funeral options for yourself or a family member? Get in touch with our ladies today, and we can provide you the guidance you need.