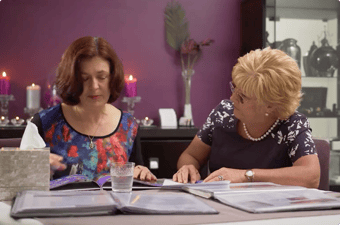

When it comes to planning for your retirement financially, the best advice comes from the professionals. From how much superannuation you need, when to plan, how to invest and the importance of planning a prepaid funeral, we have asked one of AMP's top financial planners what everyone needs to know when it comes to retirement.

"The number one tip for planning for retirement is to 'Plan for your retirement sooner (rather than later) to give yourself more time and more opportunity to reach your retirement goals'.

What I am finding as a Financial Planner, is that too many people do not seek financial advice (if they seek it at all) until it is too late. For example – often they have already retired or their retirement is imminent. Also, retirement – from a financial point of view, is not simply the date that you cease working. Retirement is a myriad of personal and financial considerations which can have far reaching consequences.

And when you get down to the crux of it – what do you want to achieve at retirement ? You want income (to live on) from your investments, minimise your tax and if possible get an age pension or part pension. What people do not realise, is that Superannuation is generally the best way to achieve all of these things. Superannuation is not simple, it is very complex and there are lots of products to choose from. There are a number of Government rules and regulations that Financial Advisors know about, and your average person does not.

So I would say to people that the most important thing you should do prior to retirement – is to get in front of a Financial Advisor, if not before – no later than age 55. We say there are three important financial 'touch points' in a person’s life – you need to be talking to a Financial advisor at age 55, 60 and 65. If you do this, I can guarantee you will be far better off (financially) than if you didn't."

Other important financial factors to consider

How much superannuation will I need?

According to the Association of Superannuation Funds Australia, for a couple to live comfortably during their retirement they will need at least $58,444 annually. For a single person the ASFA suggests that $42,569 is necessary to live comfortably. This guide assumes that individuals own their own home. For a more specific number that would see you live comfortably in retirement it's worth putting together a budget.

Create a Budget

Putting together a comprehensive budget for a ten year period will give you a good idea of how much money you need to retire on. Include things like ongoing household expenses, general living costs, travel or holiday plans, costs associated with hobbies and retirement activities. You can put this together yourself using a spreadsheet based on your current expenses.

Invest Wisely

Having a large number of assets is obviously going to be more beneficial for your retirement but having your assets in different places is also a good idea. Keeping all of your money in a superannuation account isn't the most profitable method for retirement. Invest in a number of stock or bonds, invest in property or put your money into a term deposit. There is always risk involved in any investment, so seek professional advice if you aren't confident doing it on your own. Most people find the opportunity for return is far higher when you invest diversely. By having strong and varied investments you may be able to retire sooner and more comfortably.

Take an assets test

By taking the Government's assets test for the age pension you will get an idea of what level of government assistance you are eligible for. If the plans for the 2015 budget go ahead some changes will be made to part and full pension eligibility. Though it may be something you don't want to consider just yet, putting money into a prepaid funeral plan could be a good idea as this money won't be counted towards your assets test.

Financially planning your retirement need not be a stressful process. Discuss your plans with your partner, plan out your budget and seek assistance if necessary. At Lady Anne we have been involved in the planning of a number of Sydney-sider's retirements. If you want to learn more about what a prepaid funeral entails please get in touch with one of the ladies at Lady Anne Funerals. We can give you more information about what is included in a prepaid funeral and help you plan out your arrangements to put your mind at ease and remove any possible burden from your loved ones in the future.